capital gains tax canada calculator

High net worth individuals and investors may need to consider the. Capital Gains Tax Calculator Real Estate 1031 Exchange.

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province.

. Therefore 150000 x 50. Proceeds of disposition Adjusted cost base Expenses on disposition Capital gain. This capital gains calculator estimates the tax impact of selling your show more instructions.

How much these gains are taxed depends a lot on how long you held the asset before selling. Our capital gains tax calculator determines the total tax that you will have to pay on the. Capital Gains Tax Calculator.

Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. In 2021 the capital gains tax rates are either 0 15 or 20 for most assets. See your total holdings ROI and growth over time on a beautiful dashboard.

The inclusion rate refers to how much of your capital gains will be taxed by the CRA. The taxes in Canada are calculated based on two critical variables. Total Capital Gains Tax.

As mentioned above your primary place of residence can be exempted from capital gains tax. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset. Get a glimpse of your profitloss for any tax year - for free.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. 250000 100000 150000 total capital gains Since your property is in Canada 50 of the total capital gains profit is subject to tax. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Capital gain 6500 - 4000 60 2440 Because only 12 of the capital gain is taxable Mario completes section 3 of Schedule 3 and reports 1220 as his taxable capital. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. The calculator will show your tax savings when you vary your.

Preview your capital gains. In our example you would have to include 1325 2650 x 50 in your income. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Capital gains tax calculator for Canada So how do you calculate how much tax you owe on your capital gains. Can you avoid capital gains tax by buying another house Canada. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and.

Its taxed at your marginal tax rate just like any other income. For instance if you sell a. Total Capital Gains Tax.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. How is crypto tax calculated in Canada. In Canada 50 of the value of any capital gains is taxable.

The amount of tax youll pay. How to calculate capital gains tax Capital gains tax is calculated as follows. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

New Hampshire doesnt tax income but does tax dividends and interest. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. To calculate your capital gain or loss subtract the total of your propertys ACB and any outlays and expenses incurred to sell your property from the proceeds of disposition.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Capital Gains Tax Calculation Proceeds of Disposition - Adjusted Cost Base Total Capital Gain Total Capital Gain 50 Inclusion Rate Taxable Capital Gain Taxable Capital Gain Income.

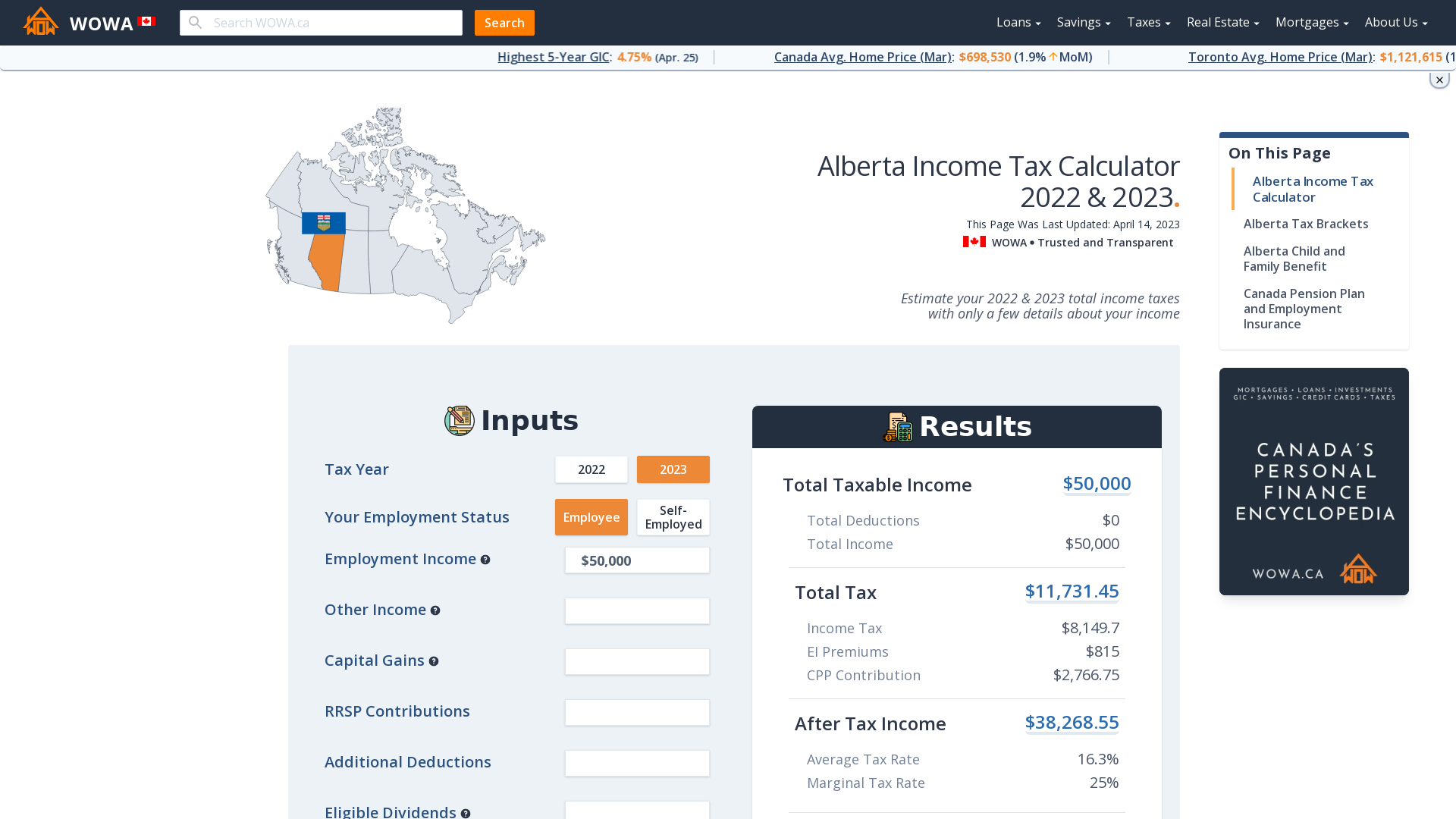

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Capital Gains Tax Calculator For Relative Value Investing

Capital Gain Calculator Estimate The Tax Payable Scripbox

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Capital Gains Tax Calculator For Relative Value Investing

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator